The COVID-19 pandemic has affected just about everything in 2020, and credit cards were no exception. From account balances to rewards offered and customer satisfaction among credit card issuers, the pandemic has altered the way consumers utilize credit.

Here’s a quick summary of what you need to know about credit cards during the COVID-19 pandemic.

1. Credit Card Balances Decreased

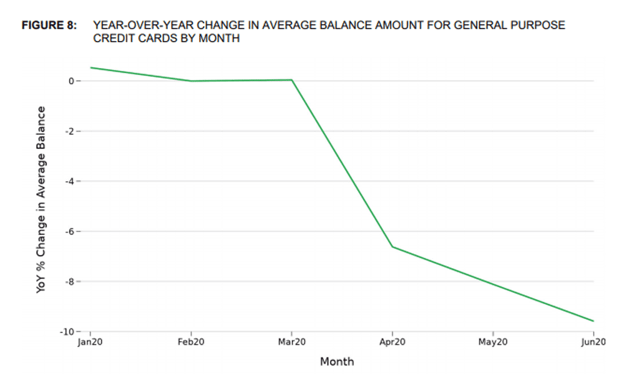

Consumers paid down credit card debt in the early months of the pandemic. Credit card balances for open accounts decreased by an average of 10% from March 2020 to June 2020, according to a Consumer Financial Protection Bureau report, “The Early Effects of the COVID-19 Pandemic on Consumer Credit.”

The report looked at 5 million credit records from TransUnion, Equifax, and Experian, the three largest U.S. credit reporting bureaus.

The incentive for debt reduction may have come from a huge wave of job losses. That’s because people who aren’t employed may have less means to afford the interest charges of carrying a balance from month to month. Paying down debt can lower the expense.

Credit card balances declined sharply between March and June 2020, with average balances almost 10% lower in June 2020 than in June 2019.

Funds for consumers to pay off debt may have come at least, in part, from government payments. Millions of taxpayers received $1,200 stimulus checks authorized by the federal Coronavirus Aid, Relief, and Economic Security (CARES) Act. Many newly jobless Americans, including large numbers of gig workers, were able to claim unemployment benefits.

The trend toward lower card balances was reflected across all demographic groups, including people in high-income and low-income neighborhoods. People who had higher credit scores, earned more income, lived in a majority-White neighborhood, or were in an area with a higher COVID-19 case rate, achieved relatively bigger drops in their card debt.

Economic shutdowns may have been a factor.

“To the extent that these borrowers lived in areas with major economic disruptions resulting from the national emergency, these borrowers may have had less opportunity to spend due to local-area closures,” the CFPB said.

The reduction in credit card debt was consistent with other data that showed a dip in consumer spending.

In a July 8 blog post, the Experian credit bureau reported that average card balances dropped 14% from $6,193 in January 2020, before the pandemic was widely acknowledged in the U.S., to $5,338 five months later.

“These trends show that, broadly, consumers across the U.S. have made some fairly drastic changes to their financial habits over the span of just a few months. Since the beginning of the pandemic, consumers appear to be either paying down their debt or at least not adding to their overall balances,” Experian said.

2. Card Debt Repayment Varied by VantageScore

is a proprietary credit scoring model created by the three major credit bureaus, Experian, Equifax, and TransUnion.

According to the company, consumers with an excellent VantageScore dropped their credit card balances by 23.2%, on average. That was the biggest reduction among the credit score categories.

Consumers with a good VantageScore dropped their card balances by an average of 11.8%. That reduction was similar to the average drop of 12.6% for consumers with a very poor VantageScore.

Consumers with a fair VantageScore dropped their card balances by an average of 7.2%. The average debt reduction for consumers with a poor VantageScore was 8.1%.

3. Credit Card Delinquencies Declined

The CARES Act offered financial relief for borrowers with student loans and home mortgages, but not credit cards. Instead, credit card companies were left to make their own hardship accommodations for borrowers.

Even though the government didn’t mandate hardship assistance for cardholders, delinquencies didn’t spike in the pandemic’s early months. In fact, new card delinquencies and the share of already delinquent accounts that became more delinquent dropped from February 2020 to June 2020, the CFPB reported.

Those trends held true regardless of consumers’ credit scores or demographic characteristics. In 2019, card delinquencies had been flat or gradually increasing.

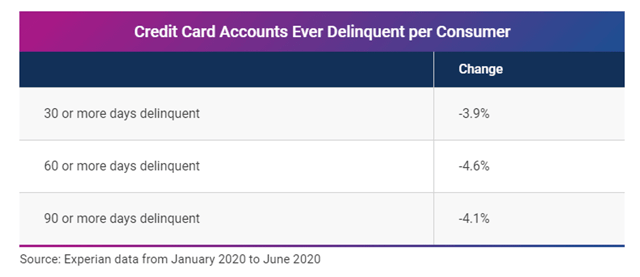

Credit cards saw the second-greatest decline in delinquent accounts behind mortgage payments from January 2020 to June 2020, according to Experian data.

Experian found the decline in 30-day credit card delinquencies dropped 3.9% per consumer from January 2020 to June 2020. A 30-day delinquency occurs when a monthly payment is past due by 30 or more days. Sixty-day delinquencies declined by 4.6%, and 90-day delinquencies fell by 4.1%.

4. Payment Assistance Kicked In

Though credit card relief wasn’t mandated, voluntary measures by the credit card companies may have helped consumers cope. Beginning in March 2020, there was a sharp increase in the share of accounts that had a balance but didn’t make a payment.

The data suggest those accounts received some sort of financial relief, according to the CFPB. Consumers who lived in areas with more COVID-19 cases, majority-Black or majority-Hispanic populations, or larger changes in unemployment were more likely to have received payment assistance.

Consumers may have felt comfortable skipping a payment since the CARES Act required card companies to report their accounts to the credit bureaus as current even if they deferred payment due to the pandemic. This protection applies from Jan. 31, 2020, until 120 days after the national COVID-19 pandemic is declared to be over.

5. Card Account Closures Increased

Card issuers didn’t just offer relief. They also took steps to curtail the amount of credit that was available for consumers. Companies closed accounts, lowered limits, and halted credit limit increases on open accounts.

Overall, credit limits on existing card accounts declined slightly between March and June 2020. Previously, credit limits had been generally on the rise.

More than half of the closed accounts belonged to borrowers with very high credit scores perhaps because those consumers tend to use less of their available credit. Many of the closed accounts were inactive.

“Super-prime and prime borrowers may have more unused credit on existing accounts and more unused or inactive credit lines, compared to lower credit score borrowers.” — The CFPB

dropped to a record low of 25% overall in May 2020, down from 30% five months earlier, according to Experian. Credit utilization measures the percentage of available revolving credit that consumers are using at a given time.

6. Credit Card Interest Rates Dipped, Then Rebounded

In early November, the Federal Reserve reported that the average credit card interest rate rebounded slightly to 14.58% in the third quarter of 2020, after dropping to 14.52% in the second quarter compared with 15.09% in the first quarter.

Rates for cards that were charged interest followed the same pattern with a small rebound to 16.43% in the third quarter after a drop to 15.78% in the second quarter compared with 16.61% in the first quarter.

7. Credit Card Rewards Programs Evolved

Card customers love rewards programs, but not all rewards are created equal. Due to the pandemic, certain types of rewards may be less popular than they once were. Examples include travel perks, airline miles, dining out points, and ride-share rewards.

On the flip side, other rewards, such as free or discounted streaming services and points for grocery shopping, e-commerce, or delivery services, are in higher demand.

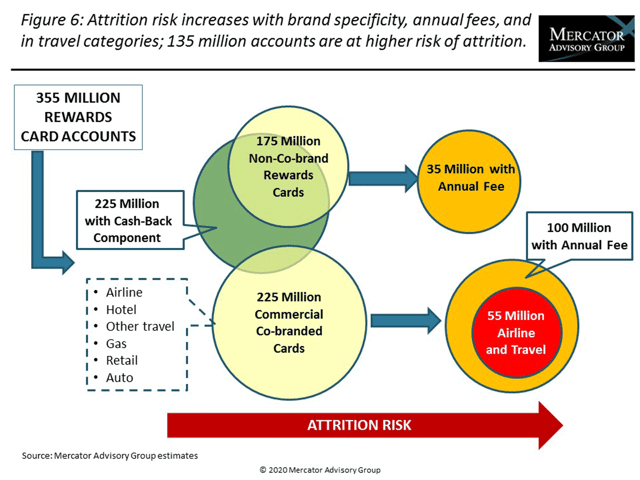

A June 2020 report by Mercator Advisory Group urged card companies to respond to consumers’ revised expectations for card rewards.

If consumers don’t like the rewards they’re getting, they could cancel millions of card accounts. Issuers that combine disappointing rewards with annual fees may prove particularly unappealing.

“While many consumers gravitate to cash-back rewards, co-brand programs that feature alliances with airlines, cruises, and hotels leave consumers with points that may not be useful for several years,” Mercator stated. “Rewards with cash options, such as those issued by American Express, Bank of America, Capital One, Chase, and Citi, will find consumers more likely to gravitate toward cash options than rewards that provide options for hospitality and travel.”

Card companies may also extend signup bonus periods and emphasize flexibility in redeeming points to enhance consumers’ interest in rewards programs.

8. Contactless Cards Gained Ground

and mobile payments were having a moment this year, thanks at least in part to concerns about the potential spread of COVID-19 on surfaces.

Sixty-nine percent of retailers said they accepted some type of contactless payment, according to a survey released by the National Retail Federation (NRF), a trade group that represents retail businesses. That total included 58% of retailers that accept contactless cards and 56% that accept mobile payments.

Contactless cards can be waved near or tapped on a card reader to make a payment. Mobile payments can be made with a digital wallet that stores a card on a mobile device.

Since January, 69% of surveyed retailers that accepted contactless payments reported higher use of this option. That’s no surprise as 19% of consumers surveyed said they made a digital payment in a store for the first time in May of 2020. Of that total, 62% of consumers surveyed said they’d used their phone while 56% said they’d used a contactless card.

“The pandemic has clearly driven consumers to change their behavior and retailers to accelerate their adoption of the technology,” NRF Vice President Leon Buck said in a statement.

9. Consumers Planned to Keep Their Cards

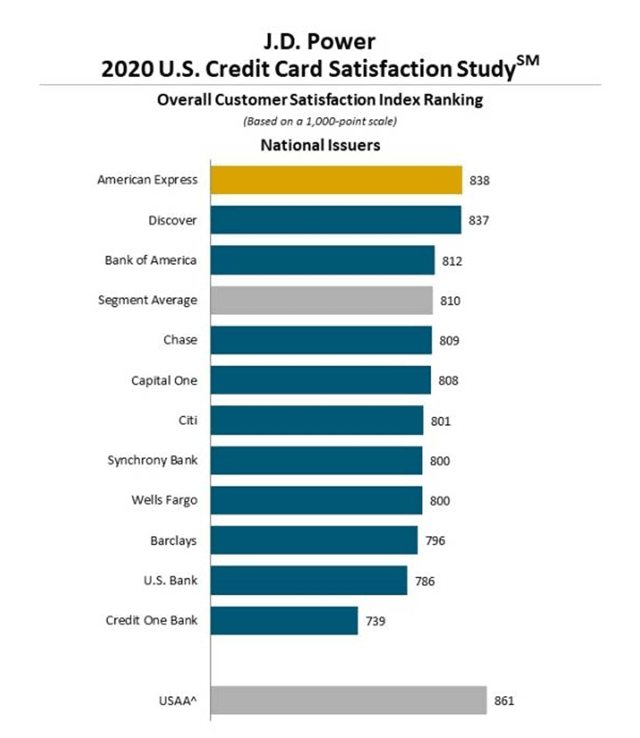

A study by consumer satisfaction tracker J.D. Power found few consumers said they planned to switch cards during the pandemic. In fact, 89% of card customers said their current card fully met their needs.

That doesn’t mean consumers were totally happy with their card companies. Rather, consumers appeared to be losing faith that their card company would help them if they needed assistance during the pandemic.

“Through the first two months of 2020, credit card customer satisfaction was on track to set record highs,” said John Cabell, director of banking and payments intelligence at J.D. Power. “That reversed course when COVID-19 entered the equation, with satisfaction, trust, advocacy and brand image attributes resulting in sharp declines in May 2020.”

Overall card satisfaction dropped 10 points on a 1,000-point scale. The decline was led by lower satisfaction with card terms and card company communications. Only 36% of card customers surveyed indicated they’d been proactively contacted by their credit card issuer during the previous 12 months.

Source: J.D. Power 2020 U.S. Credit Card Satisfaction Study.

Credit cards were an exception to the broader trend. Consumers who’d used other consumer financial services, such as retail banks and primary mortgages, reported higher levels of satisfaction during the pandemic.

That higher satisfaction may have been due, in part, to better or more frequent communication. J.D. Power found 60% of mortgage customers and 48% of retail banking customers recalled receiving company communications during a similar time frame.

The sharpest declines in credit card company satisfaction were among consumers who were in the affluent/mass affluent group or were financially affected by the pandemic. Satisfaction in both groups declined 14 points since the start of the pandemic.

Overall, the COVID-19 pandemic has had a huge impact on the U.S. economy. Consumers and card companies have felt the effects and adjusted their behaviors accordingly.

“Issuers should ensure that customers understand the terms and benefits associated with their cards, and customers, in turn, should be willing to change cards if fee-based perks or travel points are no longer relevant in the current environment,” J.D. Power stated.

How to Choose a New Card

If you’re in the market for a new card or just want to research your options, follow these four simple steps:

- Decide how you plan to use your new card. If you plan to pay off your balance every month, you won’t need to worry much (if at all) about your card’s annual percentage rates (APRs). In that case, you can shop primarily for the benefits and rewards you want. If you’re going to transfer or carry a balance, your APRs will likely matter more to you. If that’s the case, you’ll want to shop for cards with lower rates.

- Check your credit. If your credit score is good or excellent, you’ll be able to choose from a wider variety of cards, including those with the top benefits and rewards. If your credit’s fair or poor, you may have fewer options, but many good cards for these credit categories are still available. If you’ve struggled with credit or don’t have much experience with it, you may want to consider a secured card. This type of card requires a deposit but is usually easier to get approved for.

- Shop around. Cards tend to be grouped in categories based on the type of card, rewards offered, credit qualifications, or other criteria. Types of cards include business cards, prepaid cards, student cards, secured cards, and balance transfer cards. Types of rewards include travel, dining, shopping, and cash back. Credit qualifications range from poor to excellent credit scores. Reading reviews can help you decide which card you want. Before you apply, you should also read the card disclosures, which include the fees you may be charged.

- Apply online. Though you can apply for a card on the phone or by U.S. mail, filling out an application online is generally the easiest and fastest way. Most online card applications can be completed in five minutes or less, and you may receive a response within a few minutes. Once you’re approved, it may take a few weeks to receive your new card in the U.S. mail. When it arrives, you’ll need to activate it online or with a quick phone call. Then you’ll be ready to use your card to purchase the products and services you want.

With the COVID-19 pandemic far from over, the right cards in your wallet may be a huge help.

Advertiser Disclosure

CardRates.com is a free online resource that offers valuable content and comparison services to users. To keep this resource 100% free, we receive compensation for referrals for many of the offers listed on the site. Along with key review factors, this compensation may impact how and where products appear across CardRates.com (including, for example, the order in which they appear). CardRates.com does not include the entire universe of available offers. Editorial opinions expressed on the site are strictly our own and are not provided, endorsed, or approved by advertisers.

![11 Best Credit-Building Credit Cards ([updated_month_year]) 11 Best Credit-Building Credit Cards ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/06/build.png?width=158&height=120&fit=crop)

![How Many Credit Cards Should I Have for Good Credit? ([updated_month_year]) How Many Credit Cards Should I Have for Good Credit? ([updated_month_year])](https://www.cardrates.com/images/uploads/2018/07/howmany.png?width=158&height=120&fit=crop)

![7 Best Starter Credit Cards to Build Credit ([updated_month_year]) 7 Best Starter Credit Cards to Build Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2020/03/Best-Starter-Credit-Cards-to-Build-Credit.jpg?width=158&height=120&fit=crop)

![7 Best Credit Cards For Building Credit ([updated_month_year]) 7 Best Credit Cards For Building Credit ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/02/Best-Credit-Cards-For-Building-Credit.jpg?width=158&height=120&fit=crop)

![7 Credit Cards With Free Credit Monitoring ([updated_month_year]) 7 Credit Cards With Free Credit Monitoring ([updated_month_year])](https://www.cardrates.com/images/uploads/2021/04/Credit-Cards-With-Free-Credit-Monitoring.jpg?width=158&height=120&fit=crop)